Although 2021’s record breaking year for IPOs was expected to remain out of reach in 2022, the lack of initial public offering activity has been troubling for investors to see whilst more companies seek to delay their listings until economic volatility begins to ease.

For Q1 of 2022, we saw some good momentum carried over from Q4 2021 quickly wane in the second half of the quarter as geopolitical tensions in Eastern Europe intensified, mass investor sell-offs surrounding stocks in favor of more traditional safe haven commodities like gold.

As January 2022 posted the strongest opening month for IPO proceeds for 21 years globally, stock market declines slowed momentum dramatically – leading to an overall decline in activity.

For Q1 2022, the global IPO market saw 321 deals take place, raising $54.4 billion in proceeds as a result. These figures represented a 37% and 51% decrease in proceeds respectively in comparison to 2021’s performance.

(Image: PwC)

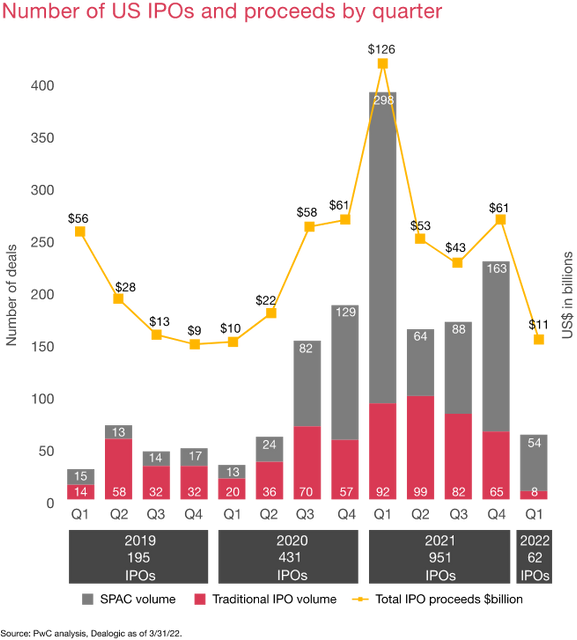

By looking at what such a downturn looks like in a visual sense, we can see US IPO momentum in Q1 2022 slowed to levels that hadn’t been seen since the early days of the pandemic. With just eight traditional IPOs taking place, the majority of deals were driven by SPACs.

Such a significant reversal following a bright 18 months of activity can be down to many reasons. Geopolitical tensions in Russia, higher stock market volatility, tech stock price corrections in the wake of blistering rallies in late 2020 and early 2021, rises in the cost of living, and the lingering threat of further Covid-19 complications have all played a role in this troubled climate.

As well as a significant decline in IPO activity around the world, we also saw a fall in cross-border IPOs generating proceeds above $1 billion. As leading companies like WeTransfer, Justworks, and Spanish bank Ibercaja have already postponed their initial public offerings due to market uncertainty, can 2022 host any form of recovery ahead for its IPO market?

Will a Recovery be Possible in 2022?

According to Maxim Manturov, head of investment advice at Freedom Finance Europe, we can already see some signs of the IPO market stirring despite difficult economic circumstances.

“Strong volatility has temporarily halted market placements, which has lasted for just under a month. Companies have now started filing or renewing applications again,” Manturov explained. “Indirect evidence of the ‘return of the IPO market’ are the offerings of smaller companies, as well as the start of SPAC offerings. For example, two offerings took place on February 18, 2022, when Blue Water Vaccines went public with $20 million, and on March 10 when The Marygold Companies floated with $3.3 million.”

“Now the market expects larger offerings. As for blockbuster IPOs like Stripe, its offering is still expected in 2022. That being said, amid weakness in the fintech company sector, Stripe could come in below its latest $95bn investor price, with one shareholder, Fidelity. For example, adjusting the value of its investment in Stripe by 9% following a sell-off in the tech company market.”

Although there may be signs of life as the IPO market tiptoes around the major issues arising from Russia’s conflict in Ukraine, it remains unlikely that we’ll see the same levels of proceeds being raised from 2022’s IPO market.

One of the major repercussions of the rise of inflation to record breaking levels in late 2021 was the corrections experienced by bloated tech companies around the world. With FAANG-oriented ETFs like the Invesco QQQ Trust and Vanguard Growth ETF down by between 17%-18% respectively since the beginning of the year, it’s clear that a reversion to levels more familiar in pre-pandemic times is underway.

End of the Line for SPACs?

Another factor that could impact the 2022 IPO market revolves around SEC proposals that could strip special purpose acquisition companies (SPACs) of their advantages over more traditional IPOs – with more uncertainty emerging for private companies looking to go public in the US. The SPAC boom kicked off in 2020 and rose to record-breaking levels in 2021 as the majority of company listings arrived through mergers.

Significantly, the SEC’s proposals will remove the ‘safe harbor’ protections that enable startups being acquired by SPACs to provide more forward-looking projections than traditional IPOs are allowed to use. The regulations could mean that companies must provide more complete disclosures for investors, and to lay bare more potential conflicts of interest between SPAC sponsors and their target companies.

“A lot of SPACs that would have normally approached these companies are facing more and more scrutiny and are really going to have to make a tough decision,” said Phil Haslett, EquityZen founder and CSO. “So I do think this [slowdown] is going to be a bit sustained. The kind of key indicator we’ll look at to see if the window will open back up a bit more is once you see some of these kind of bellwether tech names — so think of companies like Peloton (PTON), Zoom (ZM), DocuSign (DOCU) — start trading kind of back above even pre-pandemic levels to kind of show that maybe the worst is behind us.”

Although the IPO market is unlikely to see the level of revenue and volume of deals posted in 2021, many market commentators will argue that the current stock market volatility has paved the way for an overdue correction on overly inflated tech stocks that built up ahead of steam amidst favorable market conditions in late 2020 and early 2021.

As a result, we can expect the IPO market to regain some much needed consistency in 2022, with more reasonable valuations for investors to embrace. This year’s IPO market may not be the frenzy experienced in 2021, but it could still come as a breath of fresh air for investors spooked by unsustainable company valuations.

Trackbacks/Pingbacks