Key Takeaways

- SpaceX closed a funding round in December, raising $750 million.

- In mid-2022, SpaceX raised $250 million.

- Individual investors can’t invest directly in SpaceX, but other options exist.

SpaceX recently completed another round of funding and raised $750 million. The cash will help the company as it embarks on new missions in 2023 and beyond.

Here are the details about this round of funding, what it means for the company, and how investors can invest in this industry.

What the New Round of Funding Means

The latest round of funding for SpaceX puts the company’s value at $137 billion. SpaceX plans to use the money to develop its ambitious Starship program. This program is planning on being the first manned mission to Mars.

However, this is only the latest in a series of offerings to help boost SpaceX’s value. It comes on the heels of equity financing that was executed in July 2022 and raised roughly $250 million. In total, SpaceX raised over $2 billion in 2022.

SpaceX has ambitious goals for 2023. It has plans for up to 87 rocket launches, has partnered with NASA for a sustained moon exploration project, and is focused on expanding its Starlink internet service for remote areas, including Australia.

Additionally, in December, NASA asked SpaceX about returning three astronauts from the International Space Station.

SpaceX Successes

SpaceX was the first aerospace company to engineer and successfully fly reusable space rockets. The rockets have been used primarily to deliver satellites into orbit, then return to Earth for re-use.

Two types of rockets are currently in use for delivering payloads to space, including the Falcon 9 and the Falcon Heavy. So far, SpaceX has not performed manned missions. However, it’s working with NASA for a planned long-term lunar exploration mission.

The company hasn’t held back in terms of exploring other areas of the aerospace industry. Its satellite internet service, Starlink, has reached around a million rural and remote customers who had to deal with dial-up internet or low-quality satellite Internet service.

This service was also provided to Ukraine to help it fight against Russia. It proved that SpaceX could deliver reliable satellite internet anywhere in the world.

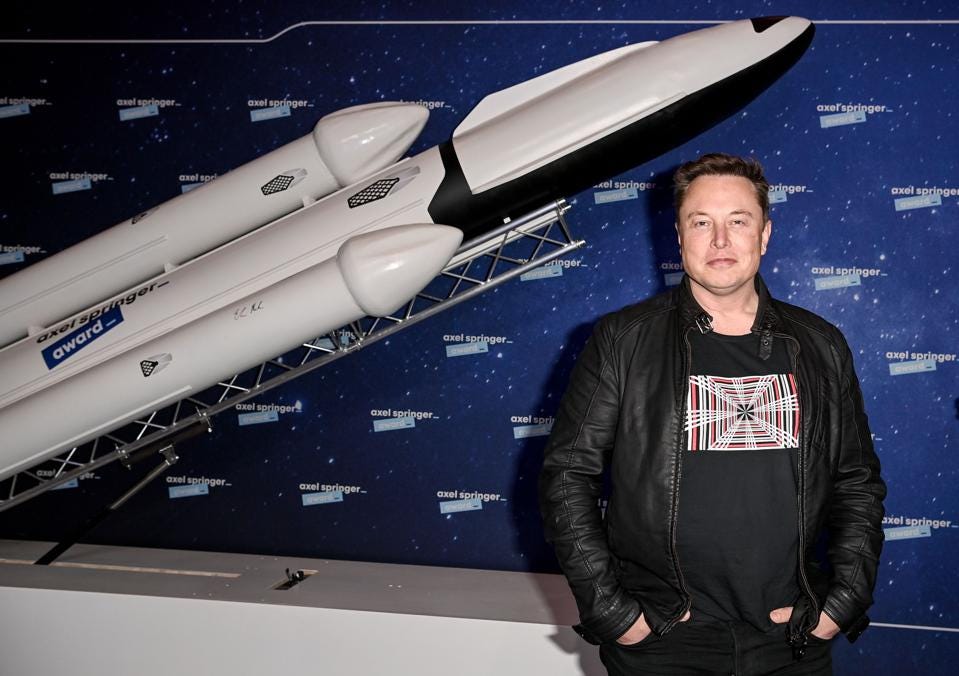

Impact of Twitter on SpaceX

Elon Musk’s purchase of Twitter has resulted in his extended absences from running SpaceX and Tesla. Major investors in Tesla have publicly spoken, asking Musk to resign as CEO from either Twitter or Tesla. In some instances, investors asked him to step down from both.

While Musk is the CEO of both Twitter and Tesla, the day-to-day operations of SpaceX are run by president and COO Gwynne Shotwell. Shotwell has worked for SpaceX since it launched in 2002 and was quickly appointed to the board of directors.

Even though Shotwell has done an excellent job of running SpaceX and keeping Musk’s expectations in check, she has to contend that his antics tarnish the brand.

SpaceX’s largest customer is the U.S. government, and Musk’s management of Twitter is upsetting some people in the government. Losing government contracts due to his actions on Twitter could severely cripple the company or cause it to fold outright.

Musk has seemingly calmed down and managed to moderate himself, but he’s also exhibited this pattern of behavior in the past. It remains to be seen if he’s reigned himself in because he’s realized what he’s risking or if this is simply a calm before another one of his storms.

Investing in SpaceX

Space is a hot investment, as billionaires Jeff Bezos and Richard Branson are also interested in exploring the universe. Both men are working on building space businesses. This includes Blue Origin for Bezos and Virgin Galactic for Branson.

While these companies are targeting the idea of getting consumers to experience what space is like, there is no reason why they would not venture into getting people to the moon or Mars.

Of these companies, only Virgin Galactic (SPCE) is publicly traded. Blue Origin and SpaceX are private companies, so you’d have to be involved in a funding round to invest.

Unfortunately, for most investors, the opportunity to be involved in a funding round is unlikely. These investment opportunities are restricted to a small percentage of people and businesses with millions to invest.

This isn’t like typical investing, where investors can each invest $100 and own a small share of the company.

Since investing in SpaceX is off the table, another option is to look into investments that deal with emerging technology, as this is the core of how these companies operate.

While you could spend your time researching individual companies in this sector, a more straightforward solution is to invest in the Emerging Tech Kit offered by Q.ai.

This kit invests in multiple companies, helping you to spread your risk. With its use of artificial intelligence, the ETF can rebalance the kits based on its projections for how the stocks within the fund will perform. Q.ai takes the guesswork out of investing.

Our artificial intelligence scours the markets for the best investments for all manner of risk tolerances and economic situations. Then, it bundles them up in handy Investment Kits that make investing simple and strategic.

Best of all, you can activate Portfolio Protection at any time to protect your gains and reduce your losses, no matter what industry you invest in.

Bottom Line

This will not be the last round of funding for SpaceX. It will be interesting to see the company’s valuation as we potentially enter a recession. The fact that SpaceX was able to raise this amount of money in the face of a slowing economy shows how much investors believe in it.

The only wildcard that can come into play is Elon Musk and if his attention is diverted away from SpaceX or he does something that harms the perception of his company.

Trackbacks/Pingbacks