- Upon transaction closing, the newly combined companies will trade on the Nasdaq under the name “Triller Group Inc.” with new expected ticker “ILLR”

- Transaction closing is anticipatedto occur soon, subject to regulatory clearance, approval by AGBA’s shareholders and other customary closing conditions

- Merger will create a cutting-edge, next-generation, social media and entertainment platform for creators and users, powered by AI and machine-learning technologies

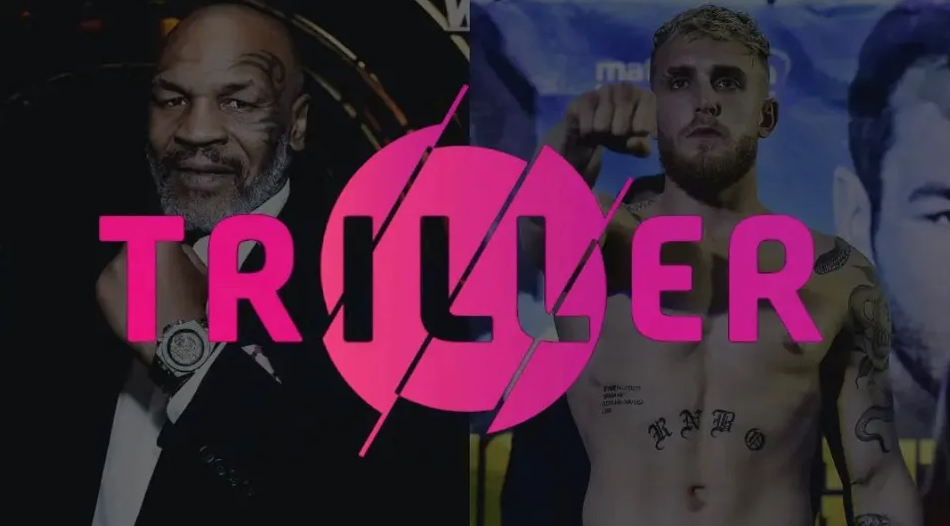

LOS ANGELES, Sept. 03, 2024 (GLOBE NEWSWIRE) — AGBA Group Holding Limited (Nasdaq: AGBA) (“AGBA”), a multi-channel business platform delivering first-class financial services through machine-learning technologies, and Triller Corp. (“Triller”), a next generation, AI-powered, social media and live-streaming event platform, today announced that on August 30, 2024, the parties amended and restated their April 16, 2024 merger agreement (“Merger Agreement”). This amended and restated Merger Agreement supersedes the original merger agreement between AGBA and Triller.

In accordance with the Merger Agreement, AGBA will domesticate to the U.S. (“AGBA Domestication”) as a Delaware corporation (“AGBA Delaware Parent”) and all AGBA ordinary shares, par value $0.001 per share, will automatically convert into the same number of shares of AGBA Delaware Parent upon successful AGBA Domestication and Delaware incorporation. Once the Triller Reorganization and the AGBA Domestication have occurred, the combined companies will merge (the “Merger”) and Triller will become a wholly owned subsidiary of AGBA Delaware Parent. Upon successful closing of the transaction, AGBA Delaware Parent will change its name to “Triller Group Inc.” and the newly combined companies will operate under the Triller company name and expect to be traded on the Nasdaq under the ticker “ILLR”.

The merger consideration provided for in the Merger Agreement (the “Merger Consideration”) will be as follows: AGBA Delaware Parent (i) will issue 299,897,852 shares of AGBA Delaware Parent Common Stock to the current common stockholders of Triller, (ii) will issue 37,702,230 shares of preferred stock to the current preferred stockholders of Triller (the holders of Triller’s common and preferred stock are referred to together as the “Stockholders”), and (iii) will convert all existing Triller restricted stock units into 54,020,128 AGBA Delaware Parent restricted stock units; and AGBA Delaware Parent also will reserve an aggregate of 54,020,128 shares of AGBA Delaware Parent Common Stock for future issuance upon the vesting of such restricted stock units. A total of 50,000,000 shares of AGBA Delaware Parent Common Stock will be held in escrow as reserved shares, which will be applied toward future settlement of certain Triller legal and financial obligations.

AGBA and Triller have agreed that the closing of the Merger (the “Closing”) will occur as soon as possible, subject to regulatory clearance, approval by AGBA’s shareholders and the other closing conditions provided for in the Merger Agreement and summarized in the accompanying 8-K U.S. Securities and Exchange (“SEC”) filing.

For more details, please refer to AGBA’s Report on Form 8-K filed with the SEC on September 3, 2024. The latest press release is available on the company’s website, please visit: www.agba.com/ir.

About AGBA:

Established in 1993, AGBA Group Holding Limited (Nasdaq: “AGBA”) is a leading, multi-channel business platform that incorporates cutting edge machine-learning and offers a broad set of financial services and healthcare products to consumers through a tech-led ecosystem, enabling clients to unlock the choices that best suit their needs. Trusted by over 400,000 individual and corporate customers, the Group is organized into four market-leading businesses: Platform Business, Distribution Business, Healthcare Business, and Fintech Business.

For more information, please visit www.agba.com

About Triller:

Triller is a next generation, AI-powered, social media and live-streaming event platform for creators. Pairing music culture with sports, fashion, entertainment, and influencers through a 360-degree view of content and technology, Triller uses proprietary AI technology to push and track content virally to affiliated and non-affiliated sites and networks, enabling them to reach millions of additional users. Triller additionally owns Triller Sports, Bare-Knuckle Fighting Championship (BKFC); Amplify.ai, a leading machine-learning, AI platform; FITE, a premier global PPV, AVOD, and SVOD streaming service; and Thuzio, a leader in B2B premium influencer events and experiences.

About an hour and 50 minutes after liftoff SpaceX confirmed that both Maxar-2 satellites were successfully deployed.

These are the third and fourth WorldView Legion satellites operated by Maxar Intelligence, an Earth observation company based in Westminster, Colorado. They are the first Maxar satellites launched into mid-inclination orbit, allowing them to observe areas between 45-degrees north and 45-degrees south latitude, providing coverage of most populated regions. This inclination enables frequent revisits over a wide range of latitudes. The first two WorldView Legion satellites are in a near-polar orbit.

WorldView Legion are electro-optical imaging satellites — with resolution of 30 centimeters — used to collect imagery and map the planet. Maxar Intelligence is the U.S. government’s primary provider of commercial electro-optical imagery. The company in 2022 won a $3.2 billion contract from the National Reconnaissance Office to supply imagery and mapping services over a decade.