There has been a lot of hand-wringing about the future of the cloud in the markets recently, with a market correction in some of the high-flying cloud technology stocks. But the markets are likely to bounce back. The market for cloud technology innovation will remain strong for many years as we undergo a massive technology shift putting applications, data, and intelligence in the cloud.

Commitments to digitization are increasing, hybrid workforces demand better cloud connectivity, and cybersecurity is an every-growing concern. These factors will keep the venture market committed to cloud technology investment. It’s proving to be a robust area for innovation, with hundreds of cloud technology startups raising a total of about $100 billion over the past two years, according to financial research firm Tracxn. With many cloud markets growing between 40%-100% per year, it’s unlikely that this trajectory will shift any time soon.

Futuriom tracks important venture-backed startups in the cloud infrastructure, networking, communications, and cybersecurity spaces. We have just released our new list of exciting Futuriom 40 (F40) companies with IPO potential over the next few years. This list of F40 companies has raised a total of $13.3 billion to pursue opportunities in cloud and communications markets.

Our research also included a detailed look at the key cloud technology innovation themes and the macro underpinnings for cloud and communications infrastructure. The strong macro trends supporting the market include a tectonic shift toward hybrid work environments, the ongoing rollout of higher-bandwidth fiber and 5G services, and ongoing corporate investments in digital transformation projects. This will drive further demand for cloud innovation and potential future initial public offerings (IPOs) of cloud technology companies.

What’s Hot and What’s Not?

The cloud markets are huge and the startups aplenty, so we have broken up our view of private venture-funded startups into three investable cloud technology themes: unified cloud security, distributed cloud infrastructure, and cloud data management. Let’s recap each of these broad themes and the companies to watch in each space.

Unified Cloud Security: Cybersecurity risks and solutions are multiplying by the day. One trend in cloud infrastructure is to build more integrated cloud cybersecurity solutions that can help unify a variety of cybersecurity data sources and tools to feed analytics platforms, helping cybersecurity teams streamline their process to drive a more complete and automated cybersecurity posture.

Additional trends in cybersecurity include the zero-trust movement, a software-driven approach to verifying user or application identity across multiple vectors; and confidential cloud – securing data in cloud computing environments. The companies to watch in the Unified Cloud Security space include Anjuna, Aryaka Networks, Aviatrix, Cato Networks, Devo Technology, Dragos, Elisity, Exabeam, Fortanix, Infiot, Lacework, NetFoundry, Netskope, Orca Security, Stellar Cyber, Tigera, TrueFort, and WiteSand.

In many cases, traditional enterprise networking architectures aren’t useful for connecting to the cloud applications and platforms. A new crop of companies is working on cloud networking and distributed data workload automation approaches. Key companies to watch in this space include Alkira, Arrcus, Aryaka Networks, Aviatrix, Benu Networks, CAST AI, Celona Networks, DriveNets, Exabeam, Fungible, Infiot, Itential, Kentik, Macrometa, Netris, PacketFabric, Pluribus Networks, StackPath, Triggermesh, Versa Networks, and WeaveWorks.

Cloud Data Management: Data is at the heart of the cloud. A wide variety of data management technologies, including cloud databases, are needed to store, handle, and secure data. We have seen an explosion of innovative new companies that help improve the flow, management, and security of data in the cloud. Cloud data management companies to watch include Cockroach Labs, Databricks, Fivetran, Fungible, Hazelcast, Macrometa, and Rubrik.

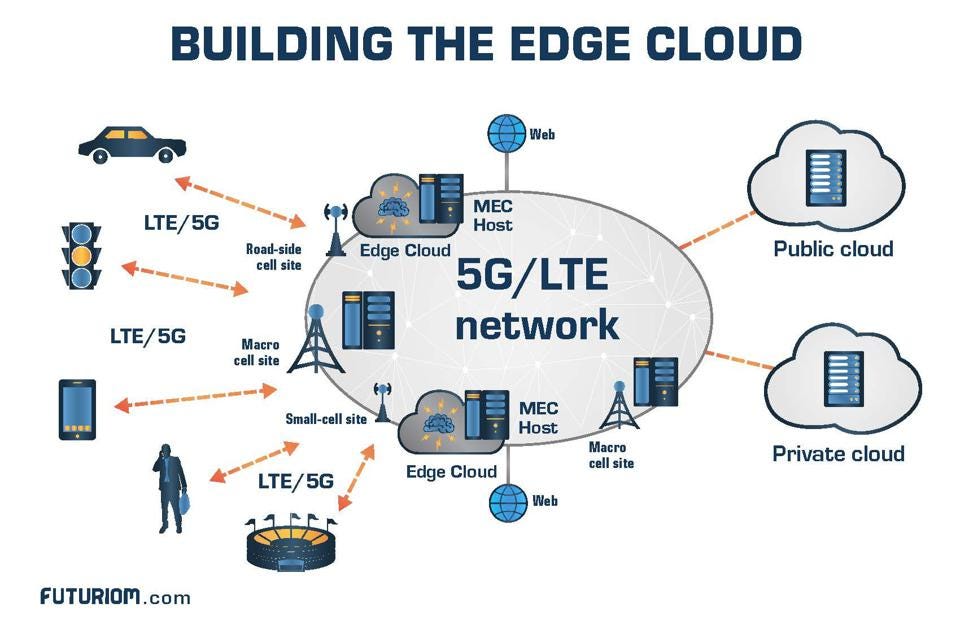

Many of the companies in the F40 are developing technology to fuel the buildout of the edge cloud.

FUTURIOM.COM

The Tech IPO Train Rolls On

What are the prospects for exits for our F40 companies? Pretty good. Already the list has a good track record. Our new 2022 list included companies that replaced those that exited the list in 2021 with successful M&A or IPOs. Five of the companies in last year’s F40 list (2021) had healthy exits with multi-billion dollar valuations, including blockbuster IPOs. These F40 companies included Auth0 (acquired in March 2021 for $6.5 billion by Okta); Cohesity (filed for IPO in December 2021 with last valuation at $4 billion); Couchbase (IPO in July 2021 at a $1.2 billion valuation); Darktrace (April 2021 IPO at a $2.3 billion valuation); and HashiCorp (December 2021 IPO at a $15 billion valuation).

In addition to these large exits, a few more companies were acquired in M&A activity, and the rest of the 12 companies that were taken off the list included those we replaced to make way for fresh blood. The companies we removed from the list included EDJX, Saguna Networks, Pensando, ZEDEDA, and Vapor.io. There’s no reason these companies can’t come back, but our analyst team decided there were companies we viewed as having more momentum — these companies had less votes.

The financial markets will remain hungry for next-generation technology, and the flurry of M&A activity and IPOs is likely to continue for the cloud in 2022. There’s an appetite from larger companies and investors to purchase valuable businesses. Last year was a record year for technology IPOs. The telecoms, media, and technology (TMT) markets raised $237 billion in IPO proceeds in 2021, 2.5 times as much as 2020, according to research firm Global Data. Areas that were especially hot included electric vehicles, digital media, healthcare tech, Internet of Things (IoT), gaming, artificial intelligence (AI), and cybersecurity.

The recent correction in high-flying growth technology stocks (including cloud) is a positive development, allowing the market to digest the surge of capital into these markets. It’s more than likely just a pause – the cloud movement is broad and deep. The macro digitization, connectivity, and cybersecurity trends we have discussed are likely to remain in place for decades.

To summarize: Innovation continues apace as organizations need more cloud resources to accelerate applications deployment, digitize their workforce, and securely connect to customers, clouds, and employees. It will be an exciting year to watch the next crop of startups building the secure infrastructure that drives the cloud.

Trackbacks/Pingbacks