Pre-IPO Access

See the Ripple,Ride the Wave

Exclusive Pricing & Unique Exit Strategy

V2VC is a venture capital group that invests in early, mid and late stage private companies. Our general partners and investment manager conduct research on hundreds of startups and established private companies to isolate and identify the leading opportunities for our limited partners.

PRE-IPO NEWS

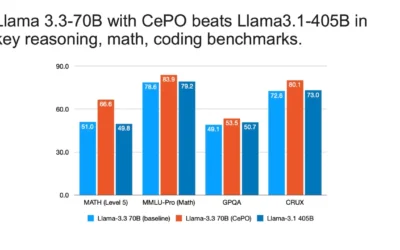

How Cerebras boosted Meta’s Llama to ‘frontier model’ performance

The company also demonstrates initial training of a one-trillion-parameter AI model on a single machine using conventional DDR5 memory chips. Cerebras Systems announced on Tuesday that it's made Meta Platforms's Llama perform as well in a...

Global Internet traffic grew 17.2% in 2024 in another banner year for Google, SpaceX, and Facebook

Internet usage has never been higher IN BRIEF: Cloudflare has published its annual year in review, and it's more of the same across multiple core categories. Global Internet traffic increased yet again, and several key players including Google,...

Cerebras video shows AI writing code 75x faster than world’s fastest AI GPU cloud — world’s largest chip beats AWS’s fastest in head-to-head comparison

75 times faster than hyperscaler GPUs, Cerebras says. Cerebras got Meta’s Llama 3.1 405B large language model to run at 969 tokens per second, 75 times faster than Amazon Web Services' fastest AI service with GPUs could muster. The LLM was...

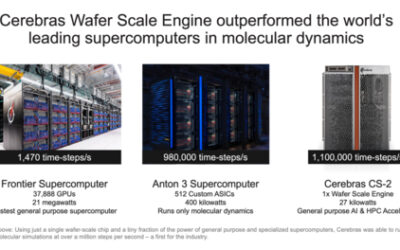

Cerebras Sets New World Record in Molecular Dynamics at 1.1 Million Simulations per Second – 748x Faster than the World’s #1 Supercomputer ‘Frontier’

Cerebras Systems, the pioneer in accelerating generative AI, in collaboration with researchers from Sandia, Lawrence Livermore, and Los Alamos National Laboratories, have set another world record and important breakthrough in molecular dynamics...

These 2 Stocks Are Nvidia’s Most Serious Competitors, But Are They Even Close?

Advanced Micro Devices and Cerebras Systems are emerging as major forces in the chip realm. For the last two years, it's been nearly impossible to tune into financial news programs or click on an article about a stock and not come across the...

I just experienced actual high-speed internet on a plane – for free, thanks to Starlink

In-flight Wi-Fi isn't universally terrible after all. Sitting for hours in one place on long flights without access to some of life's comforts and conveniences can be dreadful. In those situations, your devices are the only real escape, but...

EXECUTIVE TEAM

Kevin Brennan

Co-Founder

After graduating from Vassar College in 1995, Kevin spent over two decades as an investment professional, primarily focused on managing large teams of advisors and brokers. Kevin held various executive roles within the financial sector and built a successful broker-dealer where he served as CEO/Owner. At the same time, he continuously explored new and unique strategies to meet the goals and needs of his personal clients. In response to his investors’ ongoing search for consistent yield, Kevin launched V2VC to deliver attractive returns while focusing on diversification and full transparency not offered by current traditional investments. Kevin’s experience serving in C level positions, extensive business background, and inherent leadership qualities have been instrumental to the success of Victory Square Management.

View Bio

After graduating from Vassar College in 1995, Kevin spent over two decades as an investment professional, primarily focused on managing large teams of advisors and brokers. Kevin held various executive roles within the financial sector and built a successful broker-dealer where he served as CEO/Owner. At the same time, he continuously explored new and unique strategies to meet the goals and needs of his personal clients. In response to his investors’ ongoing search for consistent yield, Kevin launched V2VC to deliver attractive returns while focusing on diversification and full transparency not offered by current traditional investments. Kevin’s experience serving in C level positions, extensive business background, and inherent leadership qualities have been instrumental to the success of Victory Square Management.

John Conroy

Co-Founder

John Conroy is the co-founder of V2VC, LP, and Victory Square Management LLC. Before VSM was launched in 2018, John spent the previous 20 years in the Financial Services Industry working as a Financial Advisor. During his career, he owned and operated a successful brokerage firm where he focused on Investment Banking, particularly, providing seed capital to start-up and early stage ventures. Throughout this time, John forged relationships with some of the most influential, brightest, and wealthiest clients in the world. John’s extensive knowledge in capital raises and his intricate understanding of alternative investments, have paved the way for V2VC’s success. In 1995, John graduated from The State University of New York at Oswego with a B.S. in Political Science.

View Bio

John Cullen

Co-Founder

View Bio

Marcus Clapman

Partner

Meyer “Marcus” Clapman is a seasoned entrepreneur and business leader in the payment processing industry. Since 2005, Clapman has established himself as a prominent figure in the financial services sector, leading several successful Merchant Cash Advance ventures including 2nd Source Funding, Excel Corp, Mantis Funding, and Capybara Capital. His expertise in strategic investments, product development, and cultivation of ISO relationships and third-party alliances has been instrumental in achieving $3.5 billion in annual transactional volume. Under his guidance, some of these companies have become the industry’s largest Merchant Acquirers by registered representatives.

In 2021, Clapman became a partner in V2VC Fund LP, where he focuses on capital raising for pre-IPO companies and startups, further expanding his impact in the investment sector. Marcus holds a Bachelor of Judaic Laws from the Talmudic Seminary of America (1999).

View Bio

Meyer “Marcus” Clapman is a seasoned entrepreneur and business leader in the payment processing industry. Since 2005, Clapman has established himself as a prominent figure in the financial services sector, leading several successful Merchant Cash Advance ventures including 2nd Source Funding, Excel Corp, Mantis Funding, and Capybara Capital. His expertise in strategic investments, product development, and cultivation of ISO relationships and third-party alliances has been instrumental in achieving $3.5 billion in annual transactional volume. Under his guidance, some of these companies have become the industry’s largest Merchant Acquirers by registered representatives.

In 2021, Clapman became a partner in V2VC Fund LP, where he focuses on capital raising for pre-IPO companies and startups, further expanding his impact in the investment sector. Marcus holds a Bachelor of Judaic Laws from the Talmudic Seminary of America (1999).

Sean Alcoba

Chief Financial Officer

Since graduating from Columbia University in 1998, Sean Alcoba has amassed over 20 years of experience in finance and technology. Sean has extensive experience in various executive positions in Fintech, including Controller of a private equity firm and CFO of a publicly traded company. In 2014, Sean launched Tyrian Bull, a full-service merchant cash advance funding company. He ultimately guided Tyrian Bull through a private asset acquisition by one of the largest players in the merchant cash advance space. Sean’s intense passion for the MCA space and his innate talent for risk analysis, makes him an integral part of the V2VC general partnership.